LONDON—CFM International continues to boost both production and repairs to support the red-hot CFM56 market, with GE Aerospace’s Greenville, South Carolina production facility playing a central role in meeting surging new-parts demand.

CFM recently shipped the 1,700th set of its newest high-pressure turbine (HPT) blade, it said Oct. 14. Introduced in late 2023 as the latest iteration of its performance improvement program (PIP) blade, the current version targets durability improvements, particularly in harsh environments. Production volume of the newest blades at GE Aerospace’s Greenville manufacturing facility has increased 2.5x year-over-year. GE Aerospace, a 50/50 joint venture partner with Safran in CFM, also manufactures CFM56 Tech Insertion blades for engines that have not upgraded to the PIP standard introduced in 2011.

CFM projects PIP-standard engines will account for about 75% of shop visits, with overall shop-visit volume set to peak in another year or two. The Greenville plant is basing its CFM56 blade production ramp-up on that demand, GE Aerospace’s CFM56 General Manager, Engines and Services Jacey Welsh told Aviation Week.

“We’re meeting rate on the Tech Insertion blade at the same time as we’re significantly ramping the PIP blade,” Welsh said ahead of Aviation Week’s MRO Europe here Oct. 14-16. “The majority of our shop visits are on the PIP configuration, so that ramp rate has been key for us, and Flight Deck has really been able to break that free.”

GE Aerospace is leveraging its Flight Deck lean operating process and analytics model to help drive changes that balance CFM56-5B and -7B parts output with other commitments, such as the CFM Leap production ramp-up.

Demand for both the CFM56 PIP and Tech Insertion blades remains strong as operators lean heavily on CFM56-powered narrowbodies amid years of new-aircraft delivery delays and durability issues on current-generation engines. The broader trend is generating more shop visits for CFM56s and its main competitor, the IAE V2500.

Another ramification is fewer retirements, which means less used serviceable material (USM) and more pressure to deliver parts for overhauls.

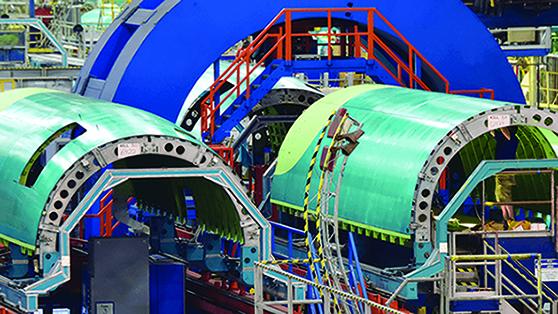

Rate changes in Greenville require more than simply running machines faster. The facility is not only the sole producer of CFM56 HPT blades but also makes turbine blades for all GE Aerospace engines. GE’s analytics is helping it zero in on sufficient rates to meet demand across its portfolio.

“We’ve seen significant improvements utilizing Flight Deck on HPT blade supply,” Welsh said. “We have even more enhancements coming that have been broken free with Flight Deck fundamentals to really help us satisfy the total demand for HPT blades.”

More new blades is only part of CFM’s support strategy. The company and its partners are ramping up repairs to help keep more parts in service longer and offer operators cost-savings alternatives.

CFM has developed more than 1,000 CFM56-5B/-7B -series repairs since the venerable variants entered service more than 30 years ago. Recently, it has focused on getting more of these repairs into shops. Some 400 repair industrializations—or instances of standing up a specific repair at a single facility—have been done since 2023, the company says.

One example is an automated laser welding process for older HPT blades that replaces a manual process. The new process, performed in GE Aerospace’s Singapore facility, keeps more parts in service and reduces turnaround times by about one-third, the company says.

“That’s going to give us more throughput, reduced turn time, as well as [make it easier] for operators to do the repairs,” Welsh said. “If we’re thinking about delivering value for our customers, cost of ownership is always a key one that comes to the forefront for them.

Continuing investment in the repairs is key. Our customers obviously would choose repair over new if available, and at every overhaul, we’re really having that dialogue.”

Besides lowering operators’ new-parts costs, investing in repairs also pays dividends on the USM side.

“The more parts we can repair, the fewer spare parts customers need,” CFM International President and CEO Gaël Méheust said in a statement. “This lowers overhaul cost and lessens demand for new material in the supply chain. The new repairs are also helping build an inventory of used serviceable material, another tool customers can use to ensure competitive cost of ownership.”